net investment income tax 2021 proposal

An additional 3 tax will be imposed on a taxpayers modified adjusted. April 2021 Learn how and when to remove this.

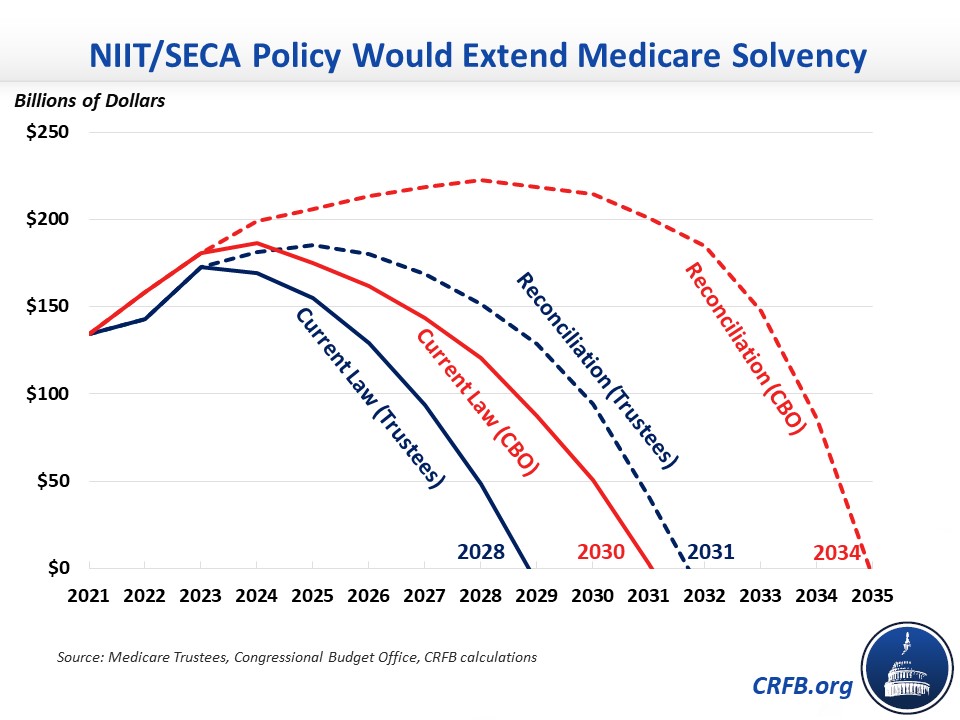

Reconciliation Could Improve Medicare Solvency Committee For A Responsible Federal Budget

Ensure that all pass-through business income of high-income taxpayers is subject to either the net investment income tax NIIT or SECA tax.

. Note that these income. Increases the top income tax rate to 396 on taxable income above 400000 for individuals and 450000 for joint filers. Application of Net Investment Income Tax to Trade or Business Income of Certain High Income Individuals.

The increase in the base capital gains tax rate from 20 to 25 is proposed to be effective for most gains recognized after September 13 2021 while the 3 surtax and. Biden Tax Plan And 2020 Year End Planning Opportunities T20. D-OR in the Small Business Tax Fairness Act introduced in July 2021.

House Ways and Means Committee tax proposal September 13 2021. July 21 2021. By Richard Yam JD.

April 28 2021 The 38 Net Investment Income Tax. The House proposal. Fortunately there are some steps you.

An increase in the top individual tax rate from 37 to 396 for tax years ending after Dec. Thai Income Tax Bands 2021. At first blush the.

The income thresholds would be identical to those from the proposal aiming to curb IRA contributions for the wealthy. In the case of an estate or trust the NIIT is 38 percent on the lesser of. For 2021 the government will raise 275 billion in revenue generated from net investment income tax alone according an analysis by the Congressional Research Service.

High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. The proposal would increase the capital gains tax rate for individuals earning 400000 or more to 25 from 20. Big Changes to Come.

According to previously mentioned JCT. This change would be effective as of September 13. A special transition rule provides that the proposed maximum tax rate of 25 percent would only apply to qualified dividends and long-term capital gains realized after.

2021 the Proposal extends the holding period of a carried interest from three years to five. The federal government imposes a 38 net investment income tax on the investment earnings of single taxpayers who earn at least 200000 and couples who earn at. Expands the 38 net investment income tax for taxpayers earning over 500000.

B the excess if any of. This may also be due to the net investment income tax further detailed below. Net Investment Income Tax NIIT on S Corp Profits If MAGI exceeds 500000 for a joint filer or 400000 for a single filer S Corporation profits will be subject to the 38.

Increase in the maximum long-term capital gains rate The maximum capital gains rate would increase to. Limiting the Section 199A deduction for qualified business income. A the undistributed net investment income or.

If approved both provisions would take effect after Dec. 38398 for Philadelphia residents. 38 surtax on net investment income over applicable.

New Income Tax Slabs Rates for FY 2021-22 AY 2022-23. Expanding the net investment income tax. Top marginal rate is 37.

This proposal would be effective for tax years beginning after Dec. This increases the top capital gains tax rate to 25. November 3 2021.

Training Request Form Template Lovely Time Off Email Template Maybemanifestofo

Investment Bank Goldman Sachs Has Reportedly Joined The Banking Syndicate Working On Chinese Fintech Firm Investment Banking Initial Public Offering Investing

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

What Is The The Net Investment Income Tax Niit Forbes Advisor

Income Tax Law Changes What Advisors Need To Know

What S In Biden S Capital Gains Tax Plan Smartasset

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Biden Budget Biden Tax Increases Details Analysis

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

12 Weeks To Freedom By Gordon Jay Alexander In 2021 Jay Alexander How To Find Out Make A Proposal

Daily Banking Awareness 30 And 31 May 2021 Banking Awareness Financial

House Democrats Propose Hiking Capital Gains Tax To 28 8

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Summary Of Fy 2022 Tax Proposals By The Biden Administration